- Chase bank incoming wire instructions how to#

- Chase bank incoming wire instructions activation code#

- Chase bank incoming wire instructions code#

- Chase bank incoming wire instructions zip#

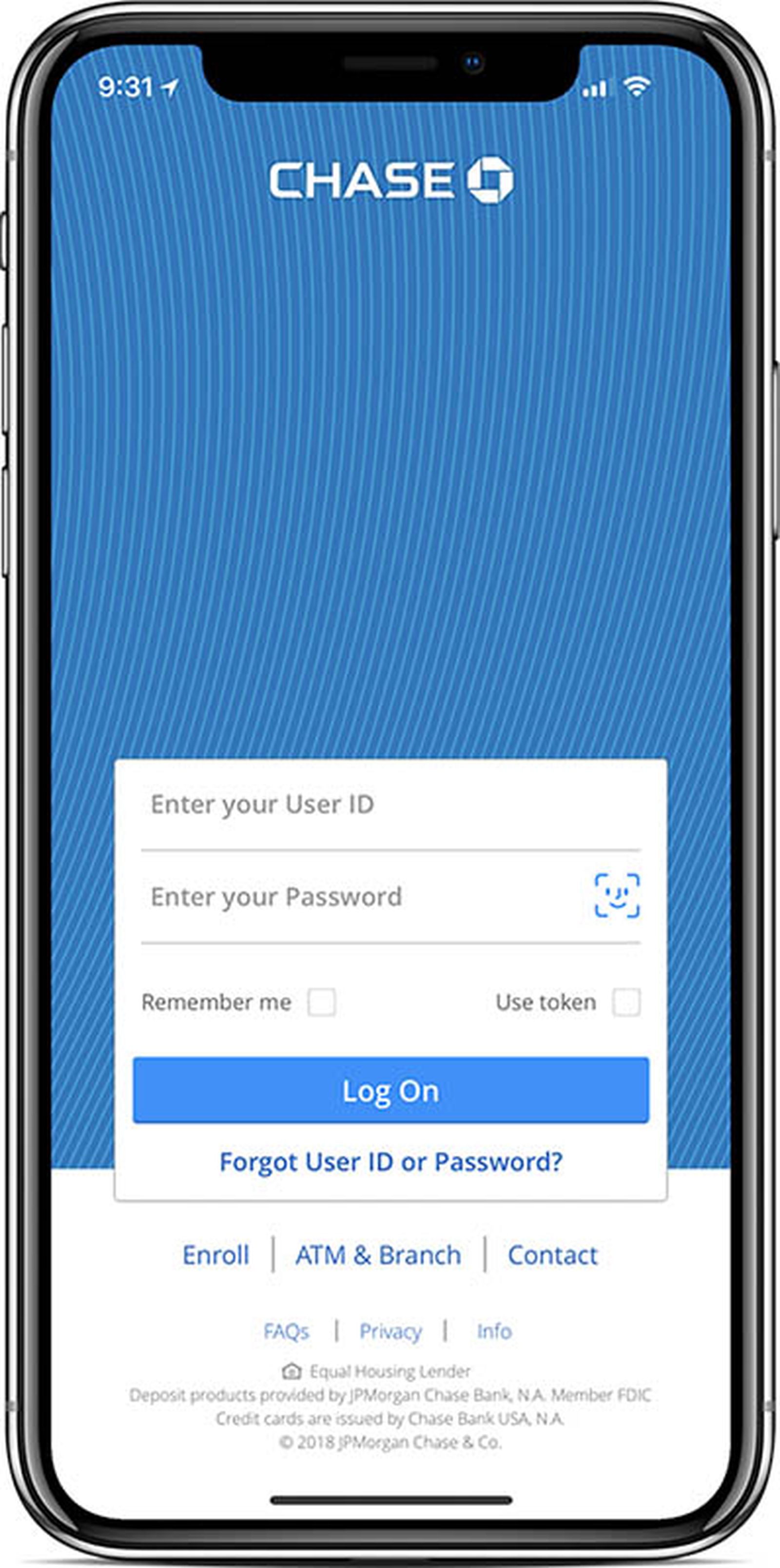

Transferring a large amount of money generally takes days for it to be done. You’ll also need a different routing number for ACH and wire transfers. Compare Up To 4 ProvidersĬhase has branches throughout the United States and uses different routing numbers for different regions. Then, take that rate and compare it with the mid-market rate using an online currency converter. Before you commit to sending money internationally, you should always ask the bank or transfer company for the exchange rate they’re going to use. If you are not a Chase customer, you can enroll in wire transfers using the link available on their banking website. When wiring money online with Chase you must first log into your online account. You can also leave a custom message directly to the bank. You’ll then be prompted to fill in additional information regarding the the receiving bank’s mailing address and bank account number. Once you’ve entered all of the recipient’s wire transfer information it will be displayed on the next page for you to verify. A wire transfer generally refers to any electronic means of sending money.Ĭhase Bank allows you receive both international and domestic wire transfers. With this number, your bank can determine whether the deposit is on hold or in progress.

Chase bank incoming wire instructions code#

A SWIFT code is an ID that banks use when sending wire transfers. If your transfer isn’t delivered within the window you were promised, you can request a trace on your transaction using the bank’s SWIFT code. We have also included the routing number used for international wire transfers and instructions for incoming wire transfers. Wiring cash takes between a few momemts to a couple days, but once you’ve started the process, you must assume that the cash is finished. So, first thing you need to know whenever you’re prepared to wire money is you’re 100per cent certain you don’t mind the cash leaving your account - quickly, and forever. A wire transfer can be harder to undo than writing a check or spending a bill via charge card. To receive an international wire transfer at Wells Fargo, you may need additional routing instructions, so you’ll want to double-check with your bank first. Chase Bank Incoming International Wire Instructions Wire transfers are also a kind of EFT payment that moves money quickly between banking institutions. 💡 If you need to send a wire transfer with Bank of America, you can also read the guide to find out more. Banks are notorious for marking up their exchange rates by an average of 4-6%. chase bank wire transfer instructions Regardless of what you hear it referred to, it’s the real exchange rate you see when you Google two currencies.

Chase bank incoming wire instructions how to#

Find out how to send an Intermex wire transfer, and the fees involved. Not only do we make it easy and fast, it’s also an inexpensive option. Wise is a simple alternative for international payments and money transfers. As someone looking for the best way to wire money to a friend or family member consider Wise. Wire transfers provide the fastest way to transfer funds into your Chase Bank account. The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act, also known as the Currency and Foreign Transactions Reporting Act. If you deposit more than $10,000 cash in your bank account, your bank has to report the deposit to the government. Chase Bank doesn’t guarantee any transfer times, and how long an international wire transfer takes can be dependent on both the sending bank and the country from which the money originates.

Chase bank incoming wire instructions activation code#

This means you’ll need to request an Activation Code from Chase before proceeding, but it should only take a few minutes to validate. After successfully logging into Chase you may have to verify your identity, especially if this is the first time sending a domestic or international wire transfer. For domestic wire transfers you can expect them to take about 1-2 business days for the funds to be received. For international wire transfers you can expect them to take 3-5 business days to be received. dollar and foreign denominated currency transfers. Please note that some banks will have different receiving information for U.S. Below are the two types of wire transfers for international use. In order to conduct these type of transfers, you will need to consider a wire transfer. Chase frequently offers cash bonuses for new banking customers.

Chase bank incoming wire instructions zip#

Recipient mailing address with city, region, country and postal ZIP code.

Foe incoming wires, the average price goes down, to about $15 per wire transaction. Some smaller banks may waive the fee altogether if you meet a minimum amount threshold ($10,000 is a common cut-off line).

0 kommentar(er)

0 kommentar(er)